Why the Global Financial System Isn't Collapsing...Yet

Why gold glitters while Bitcoin flickers

When the elephants fight, it is the grass that suffers.

— East African Proverb

Right on cue the long-expected bust-up between two huge egos, Musk and Trump, is unfolding, but look past the blizzard of coverage, and the underlying issue is, in fact, THE issue of these times. This is the trajectory of the USA, its debt, treasuries and the dollar, in other words, US solvency. Why that matters for all of us is because these interconnections are the backstop to the entire global financial system, and that includes the safety of your bank deposits, securities, pensions and money in transmission – the whole pot. In this mid-year review I get straight into the heart of it and put in juxtaposition safe havens, Bitcoin and gold.

I’ve taken a cautious stance since Trump’s inauguration pending the outcome of his first 100 days and extended the moratorium after his dramatic lunge from the Rose Garden on April 2nd, since which he’s been forced to row back on his dictats to the global economy. This is because of how the interconnection between US debt, dollars and bonds relates to the global financial system, which it anchors.

The purpose of this mid-year review is to look over the state of play now that events have moved on since the lunge and since markets have responded.

Long-term regular readers will know that I’ve been closely tracking the global financial system ever since it blew up in 2008. The end of my third last book, The Pivot in 2017, asked if Keynesian economics (which during slumps promotes vast money printing even if in excess of economic growth) would be the most dangerous doctrine carried forward from the 20th century. It isn’t. Twenty-first-century totalitarianism is more dangerous and is the subject of my current book, but it remains a close second!

The vulnerability of the financial system itself has become the hottest financial topic underpinning an explosion in reports, books, videos and politics as debt once again raced ahead of economic growth because of lockdown.

In the most recent bulletins, I’ve endeavoured to explain why this fear of inevitable insolvency is the driver behind Trump’s strategy to avoid the fate of the world reserve currency issuer, as heralded by Belgium-born economist Robert Triffin, hence the term the Triffin Curse. It is why he’s attempting to rebalance world trade through unilateral strong-arm tactics to force burden sharing on all nations. The objective is understandable; the route to achieving it is a very poor choice when compared to alternatives like a multilateral round table agreement between all partners in a new type of Bretton Woods reset. Trump instead chose to bully first, negotiate with mutual respect second, and in doing so has made the USA weaker, not stronger.

Markets have spoken, and Trump, after just two months, is in TACO mode, retreating from his bluster in the Rose Garden on April 2nd. TACO is a rather unfair summary of his negotiation style and is shorthand for Trump Always Chickens Out. This report goes straight to the heart of the underlying question based on what we now know in mid-2025, acknowledging that debt levels are highly elevated but questioning the timing of how we transition from the old debt-financed cycle to that needed to fuel the new industrial and service revolution as AI enters the field, to be followed by quantum computers and energy innovations needed to support the economic expansion it will bring.

There will be momentous change, but I believe it will be transitional and not some Hollywood moment of high drama, the stuff of a crowded field of writers and influencers selling videos, books and subscription services. Here I outline the transitional arguments and why the death of Bonds is overstated.

Why a US Bond Crisis is Not Imminent

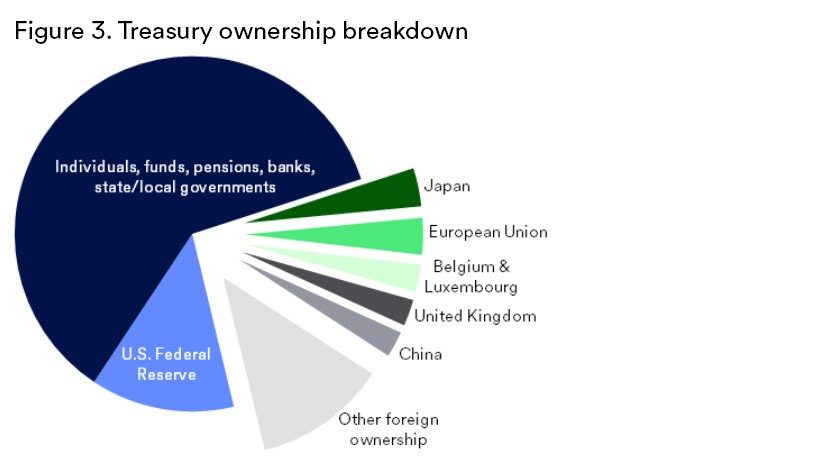

There isn’t an alternative. Not yet. It is why the U.S. bond market remains strong due to consistent global demand for its Treasuries, which are still viewed as the safest and most liquid assets globally. Remember, as stated earlier, bonds act as the backstop to the whole pot, the global banking system itself, and the safety of your capital in banks or in transmission through global banking conduits; the same applies to securities, equities, commodities, credit and trade. The government bond market is the backstop, and US Treasuries are the anchor. Keep in mind that both US Treasuries and gold are still ranked by the Bank for International Settlements (BIS) as Tier One reserve assets to offset bank runs.

This hasn’t stopped a clatter of speculation about the BRICS multi-currency platform, a federated Eurozone bond market and cryptocurrency arriving as cavalry, all of which have considerable drawbacks at present, drawbacks largely understated in fairy godmother solutions. There isn’t an alternative to the present system, not yet.

Despite rising yields for US bonds exacerbated by Trump's gambit, for example, the 10-year Treasury yield has bobbed around 4.0%-4.75% this year, but foreign investors, including central banks, continue to hold U.S. debt. Remember, when yields rise, the market value of existing bonds falls. Today’s ten-year is hovering at 4.3%, down from a recent peak of 4.6%. The dollar's role as the world’s reserve currency is reinforced by its use in over 88% of global transactions (SWIFT data) and its dominance in foreign exchange reserves (59% of global reserves per IMF). No viable alternative currency like the yuan or euro matches the dollar’s liquidity or stability.

Since the Rose Garden shock, there is mixed evidence of softness for new issues of US debt, with successful launches of 10- and 30-year bonds in April but lower cover of 20-year bonds in May. Trump is highly sensitive to markets barking at him; his retreat to 90-day moratoriums on unilateral US tariffs followed immediately after bond yield spikes.

I’ve started year-beginning analysis restating the virtuous circle of support for the US economy, notwithstanding the manifestly difficult social and political downsides of the USA. This is evident in the graphic below showing the long-term impact of US economic pre-eminence in enterprise stimulation versus Europe – with thanks to Andrew McAfee of MIT.

The U.S. economy demonstrates resilience, with GDP growth projected at 2.5-3% for 2025 (IMF and Federal Reserve estimates), driven by consumer spending, tech innovation, and energy independence. Don’t be surprised, however, if the huge uncertainty caused by Trump's mercurial lunge peels back growth this year to sub 2% for the USA. Global growth is also likely to be chipped away depending on how TACO tactics unfold over the coming months.

Global growth was expected to continue at 3.2% (IMF 2025 forecast), supported by recovering supply chains, stabilising commodity prices, and growth in emerging markets like India and ASEAN nations. The U.S. bond market benefits directly from this stability, as manageable inflation (around 2-3%) and Federal Reserve policy adjustments prevent a crisis scenario, while global growth supports demand for dollar assets.

The U.S. benefits from deep, liquid capital markets and robust institutions, including an independent Federal Reserve, and despite all the political noise, it has a stable legal system. This underpins confidence in U.S. bonds and the dollar, even amidst fiscal concerns with the debt-to-GDP ratio hovering around 120%. The absence of a credible global alternative financial system ensures that any shift away from the dollar would be gradual, not catastrophic, in my opinion.

US Treasuries give reliable income, with current yields around 4.3% for 10-year bonds, providing a strong basis for portfolio diversification. Despite all the financial media noise, foreign holders have increased their holdings more than domestic buyers since the November 2024 presidential election through the end of Q1 2025, countering concerns of foreign investors "going on strike". This is evidenced by normal auction demand, with bid-to-cover ratios and slightly weaker but orderly longer-term bond auctions, indicating reasonable overall demand.

Bid/ask spreads in US Treasury auctions suggest stability, and there is the potential for regulatory changes, like unlocking additional capacity for financial institutions to hold more Treasuries. Despite a Moody’s downgrade in early 2025, the market impact was minimal. Looking at the USA in isolation is an error; however, sovereign bond yields globally have risen because elevated debt isn’t purely a US concern but a broader market one. You’ll see here the rise globally in bond yields as markets repriced risk.

The US Treasury market has deepest liquidity, averaging $900 billion in daily transactions, but sometimes with high volume days reaching $1.5 trillion, this compares to $4 trillion in daily REPO financing between banks.

So at least for the time being research suggests the US bond market is stable, with strong demand for Treasuries and normal market functioning and that the US dollar will remain the world reserve currency, given its liquidity and lack of viable alternatives. Although the US economy is currently weakening from Trump’s manufactured uncertainty, the prevailing evidence leans toward global growth persisting, supported by US economic resilience and developing market recovery.

Other Voices

Here I look at counternarrative voices, including Ray Dalio, whom we’ve mentioned before, the highly published head of Bridgewater whose current book deals exclusively with the history and dynamics of national debt crises. Dalio warns of an imminent US bond market crisis due to growing debt, predicting a crisis within three years. Those predicting crises usually focus on three interrelated concerns: the stability of the US bond market, the dollar's status as the world reserve currency, and the persistence of global economic growth.

Dalio has warned that the US deficit, projected at 7.2% of GDP, must be reduced to 3% to avoid a supply-demand imbalance for debt. He likened the situation to a patient with a serious medical condition, predicting a crisis within three years. Dalio also compares the current scenario to historical events like the 1930s, suggesting a potential "death spiral" of rising interest rates and economic instability. You can expect Musk to chime in.

Dalio also predicted a depression in 1981-82 that did not occur, and his warnings over the last decade have not materialised. The US dollar's status as the world's reserve currency, used in over 88% of global transactions, continues to attract global demand for US Treasuries, keeping borrowing costs low. Recent Treasury auctions indicate reasonable demand, with normal bid-to-cover ratios and orderly market functioning.

Moody's downgraded the US debt rating in early 2025, citing concerns about the country's fiscal trajectory. The downgrade reflects high debt levels and rising debt service costs. This has been interpreted as a warning that the US's fiscal health is deteriorating, potentially leading to higher borrowing costs and market instability.

While the downgrade is significant, it does not signal an imminent crisis. The US has been downgraded before, such as by S&P in 2011, without triggering a bond market collapse. The downgrade reflects long-term concerns rather than an acute threat, as current economic indicators show stability. Global demand for US Treasuries remains strong, with recent auctions showing normal bid-to-cover ratios, suggesting the market continues to function normally. The argument is that the US can manage its debt through gradual adjustments and economic growth, delaying any potential crisis, making the timing of a liquidity or solvency crisis not imminent.

Some bond market participants have expressed unease about the sustainability of US deficits, pointing to signs of weakening demand at Treasury auctions and rising yields. A 20-year bond auction in May 2025 had the lowest demand since February, with investors seeking higher yields, indicating they want to be paid more for lending to the US. Rising 10-year Treasury yields and 30-year yields suggest investors are pricing in higher risk, potentially foreshadowing a crisis if deficits continue, but remember upward pressure on bond yields is a global phenomenon.

The recent volatility in the bond market, including rising yields and weaker auction demand, appears to be driven by temporary factors such as trade tensions and political uncertainty rather than fundamental shifts in the market's health.

Historical data shows that bond markets can experience short-term turbulence without leading to a crisis. This happened, for example, in the 2020 "dash for cash" episode, which recovered quickly with central bank intervention.

In summary the opposing views from Ray Dalio, Moody's, and bond market participants highlight valid concerns about the US's fiscal health and the sustainability of its debt-to-GDP trajectory. However, these views appear to overestimate the immediacy of the risks. Dalio's predictions have been historically premature, Moody's downgrade reflects long-term concerns rather than an acute threat, and bond market volatility appears temporary rather than systemic. The US economy remains resilient, with strong global demand for US Treasuries and the dollar's continued dominance as the world's reserve currency. In conclusion, a US bond market crisis or loss of dollar reserve status is not imminent in 2025, and the timing of a liquidity or solvency crisis appears to be overstated.

Why is Gold Rising?

Gold, which has advanced over tenfold since the early noughties and remains a vital asset in diversified portfolios, has become a hot topic due to its most recent surge and against the backdrop of elevated global debt. This is perfectly understandable.

Central banks buy gold for diversification, inflation hedging, and as a safe haven, and they have topped up their total gold inventories by about 10% since 2020. The question I routinely ask is if the evidence leans toward Gold being more likely than Bitcoin to feature in future currencies, given its stability and history?

Central banks buy gold mainly to diversify their reserves, protect against inflation, and act as a safe asset during economic uncertainty. Gold’s finite supply and lack of credit risk make it a trusted component of reserves, especially amid geopolitical tensions.

Since 2020, central banks have likely bought about 3,783 tonnes of gold, with significant recent purchases based on recent data from the World Gold Council.

Gold, with its long history and central bank backing, seems more likely to remain part of future monetary systems, while Bitcoin, though gaining traction, faces volatility and regulatory challenges, making its role as a currency uncertain.

Central banks hold gold as a critical component of their reserves, accounting for about a fifth of all gold ever mined. Their buying trends have intensified since 2020, driven by economic stimulus, inflation, and geopolitical uncertainties. Meanwhile, the debate over future currencies pits traditional assets like gold against emerging digital currencies like Bitcoin, each with distinct advantages and challenges.

Gold reduces reliance on other currencies, particularly the US dollar, which can fluctuate based on economic conditions. It is seen as a store of value during inflationary periods, and its finite supply makes it a natural hedge, especially when monetary policies lead to currency devaluation.

During economic or geopolitical turmoil, gold serves as a safe asset with no credit or counterparty risks. Tensions, such as sanctions on Russia, have driven banks to boost gold holdings for stability and to reduce the risk of appropriation by geopolitical opponents.

Recent years have seen increased gold buying due to trade disputes and a de-dollarisation trend. This suggests that gold’s safe-haven status is the primary driver and not a loss of confidence in the dollar, at least for the moment. These factors are supported by data from the World Gold Council, showing consistent net buying since 2010, with a surge post-2020.

Central banks have significantly increased gold purchases since 2020, with the following annual figures based on World Gold Council reports and other sources:

In 2020 purchases were 273 tonnes, as per the World Gold Council’s 2020 Gold Demand Trends; this was followed in 2021 with 450 tonnes and in 2022 with 1,136 tonnes. In 2023 demand hardly cooled at 1,037 tonnes, falling back to 887 tonnes last year. Below are the 2023 total gold reserves held by major countries.

Gold has been a cornerstone of monetary systems for centuries, with central banks holding over 35,000 tonnes globally. Its stability, universal recognition, and role in reserves suggest it will likely remain relevant. Gold’s historical performance during crises makes it a candidate for backing digital or stable currencies. While a return to the gold standard is unlikely, gold could feature in reserve-backed digital currencies, given its current 20% share of central bank reserves.

Bitcoin, launched in 2009, is often called “digital gold” due to its capped supply of 21 million coins. However, its volatility, regulatory uncertainties, and limited adoption as a medium of exchange pose challenges. Bitcoin appeals to investors seeking high returns, but its role as a currency is speculative, with scalability and energy concerns.

It is unfair but coldly accurate to compare gold and BTC, especially given the zealotry with which crypto investors advocate online for ‘digital gold’. The truth is that crypto in general exists in an unregulated marketplace with significant suspicions about pumping and dumping, false accounting of transactions, theft and straightforward fraud. Tether, a company registered in the British Virgin Islands, may be linked to the failure of El Salvador to mandate Bitcoin as legal tender through its Chivo Wallet, which has been rejected by over 90% of Salvadorans.

In December the IMF approved a $1.4bn loan to El Salvador conditional on reducing its Bitcoin ambitions. An allegation has been made that El Salvador’s Bitcoin haul was not purchased but parked in its account by Tether, which, if verified, will lead to a crisis in confidence in this major crypto player. What’s noteworthy is that institutions who rushed into crypto with funds (ETFs) to lessen investor risk are in 2025 retreating based on large net capital outflows.

Gold’s long history and central bank backing make it more likely to feature in future monetary systems, especially in stablecoin or digital currency frameworks. Bitcoin, while innovative, faces hurdles, especially in volatility and risks. Since BTC challenges nation states' control of monetary power through decentralisation, it faces significant regulatory hurdles, reducing its near-term likelihood as a currency.

In conclusion, use gold as a diversifier and BTC for a highly speculative play, knowing that most of its value could vanish in a perfect storm or that it is destined to be regulated into mediocrity.

Until next time,

Eddie

PS: For regulatory reasons investment and financial advice cannot take place outside a regulatory process. Should you ever wish to engage, contact me here.

💯💯💯👊💪👍

Hi Eddie. Thank you for all the valuable info and detailed analysis. Question, Dose our Central Bank have any gold reserves , and if so, where is it stored??

Continued success.